Frequently Asked Business Central Questions and Answers

This guide is to help better understand the basics within Business Central. Below are some of the most commonly asked questions, and recommended practices to help navigate and optimize Business Central.

Note: Screenshots in this document may not have high resolution, please refer to the text for best instructions.

Payment Journal Questions and Answers

Questions we receive:

- I posted the invoice, why don’t I see it to pay?

- I sent my request payment to accounting, why don’t I see it to pay?

- I voided the check why does this invoice keep showing up?

- I reversed the request; why does this payment keep showing up?

GENERAL RULE: check the vendor balance. The Balance represents what is owed to the vendor in total and Balance Due represents how much you own them right now. If an item appears in the payment journal that shouldn’t, or nothing shows up when it should, the vendor’s balance is a good place to start troubleshooting.

- I posted the invoice, why don’t I see it to pay?

- The Purchase Invoice didn’t post. It can still be seen under Expenses>Purchase Invoices

- The Purchase Invoice didn’t post. It can still be seen under Expenses>Purchase Invoices

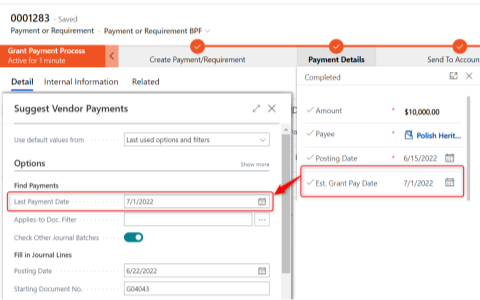

- The Last Payment Date does not include the Due Date of the Posted Purchase Invoice. Increment out the Last Payment Date when Suggesting Vendor Entries.

- Reversing an Invoice or posting a credit memo can result in the vendor having a negative balance, indicating they are not owed anything. The extra payment/check needs to be reversed/voided.

- I sent my request payment to accounting, why don’t I see it to pay?

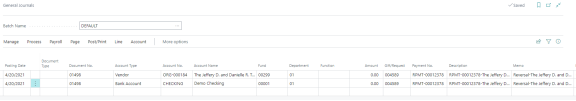

- The item did transfer to Business Central but is stuck in the AKOYA journal. The entries need to be posted from Finance>General Journal>AKOYA.

- The item did transfer to Business Central but is stuck in the AKOYA journal. The entries need to be posted from Finance>General Journal>AKOYA.

- The Last Payment Date does not include the Estimated Grant Pay Date of the Request Payment. Increment out the Last Payment Date when Suggesting Vendor Entries.

- The Request Payment was reversed when the status was still “Received” even though a payment was processed in Business Central. An adjusting entry should be posted in Business Central crediting the Vendor in the granting fund and debiting the Bank Account in the General Fund (be sure enter Request/Gift and Payment No. in the journal entry).

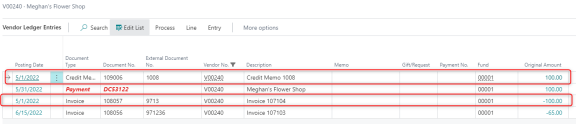

- I voided the check why does this invoice keep showing up?

- The Payment is voided putting the original invoice/request payment back into payable. The Posted Purchase Invoice should be voided as well.

- The Payment is voided putting the original invoice/request payment back into payable. The Posted Purchase Invoice should be voided as well.

- I paid the request; why does this payment keep showing up?

- The Request Payment was reversed/voided in Business Central directly. The payable should be located and reversed from the vendor ledger. Update the request payment afterwards to reflect the reversal.

- The Request Payment was reversed/voided in Business Central directly. The payable should be located and reversed from the vendor ledger. Update the request payment afterwards to reflect the reversal.

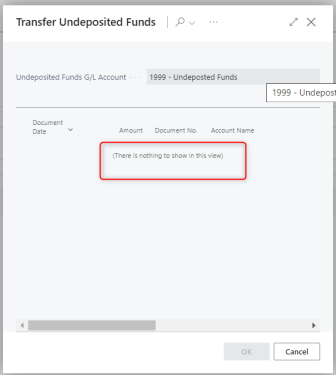

Undeposited Funds Questions and Answers

Questions we receive

- How come I don’t see my gift to deposit?

- How do I remove items from the Undeposited Funds list?

GENERAL RULE: The 1999 balance should equal the sum of items in the Undeposited Funds list. If you currently have nothing deposit, the 1999 balance should be zero.

- How come I don’t see my gift to deposit?

- The item did transfer to Business Central but is stuck in the AKOYA journal. The entries need to be posted from Finance>General Journal>AKOYA.

- Journal entry to record the income was posted to some other account other than 1999 (possibly some other receivable). Find the entry in G/L entries, reverse, and rewrite in General Journals using account 1999.

- How do I remove items from the Undeposited Funds list?

- When the automatic process for removing lines fails, they can be manually removed from the Undeposited Funds list using Ignore Undeposited Funds. When in a Deposit Batch, choose Process>Ignore Undeposited Funds. Check the item you wish to exclude from the Undeposited Funds list.

General Ledger Filter Questions and Answers

Questions We Get

- How do I see all the transactions for a Gift/Request?

- How do I find see all transactions for a donor/vendor/employee?

- How do I find all my adjusting entries/deposits/payments?

GENERAL RULE: Utilize a whole host of columns to find what you’re looking for.

- How do I see all the transactions for a Gift/Request?

- Filtering on Gift/Request is a great way to find all transactions for an entire Gift or Request, including all its payments.

- Filtering on Payment No. is a great way to find all the lines related to a single payment. Gift payments are prefixed with GPMT- and request payments are prefixed RPMT-.

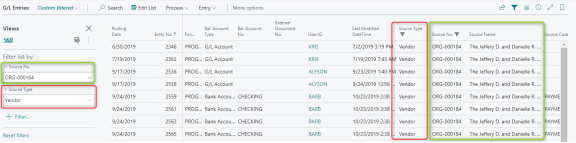

- How do I see all transactions for a donor/vendor/employee?

- Filter on Source Type/Source No.

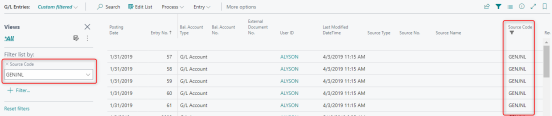

- How do I find all my adjusting entries/deposits/payments?

- Sort on Source Code

- Purchases for Invoices

- Genjnl for adjusting entries

- Paymentjnl for payments

- Bankdep for deposits

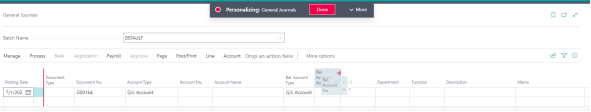

Personalization Questions and Answers

Questions We Get

- How do I modify the General Journal?

- How do I modify the General Ledger?

- How do I modify forms?

GENERAL RULE: Move columns and fields to work the way you do.

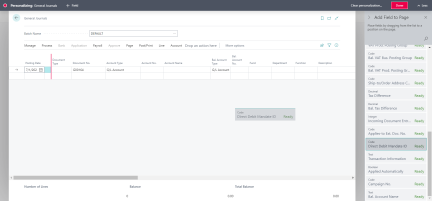

- Start by choosing Advanced Settings and then Personalize. by choosing Advanced Settings>Personalize.

- Existing fields can be moved via drag and drop.

- Hidden fields can be added first selecting “More”, + Field, and then dragging and dropping fields onto the page.